July 15, 2024 | Articles

Construction’s Digital Transformation & The Tools of Modern Project Management

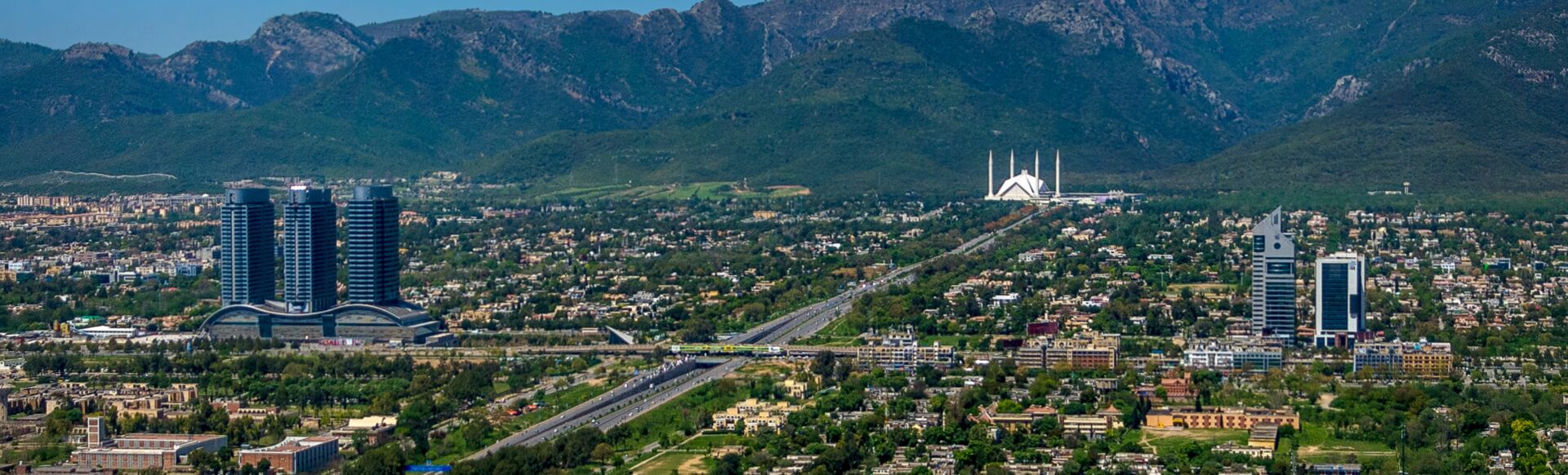

With a booming population and a government committed to rapid and sustainable growth in all economic, social, and national groups, Pakistan’s construction sector is likely to experience rapid growth—and change—in the years ahead. According to a recent report on the country’s outlook for 2023 from the Pakistan Credit Agency Ltd (PACRA), Pakistan’s construction sector may nearly double by 2030 as the triple combination of demographics, industry reforms, and government support underpin the market for the long-term.

Nevertheless, Pakistan remains in many ways an emerging market, with all of the risks and opportunities inherent in realizing ambitious construction projects present. To make the country more attractive for development, the Federal government implemented several reforms. This included removing bureaucratic obstacles and simplifying the tax system. The government also plans to confer upon the construction sector “industry status,” which incentivizes growth through:

In addition, authorities in the country continue to press for continued changes to the construction industry to support growth. This includes the Pakistan Engineering Council (PEC), led by Chairman Najeeb Haroon. Haroon notes that construction in Pakistan still lacks the defining characteristics and official recognition needed to spur sustainable, long-term growth. In addition, according to Haroon, available expertise in-country needs to grow to meet demand.

Pakistan is severely lagging in terms of its infrastructure and housing, explains Haroon. He lists dams, drainage ditches, water access, electrical grids, and roads as just a few examples. The situation is similar when speaking about Pakistan’s housing sector where the country needs an estimated 5 million more homes.

Vertical in the Short Term, Horizontal in the Long Term

In the short term, Hill International, Inc. expects growth primarily in vertical construction. Hill Country Manager Syeda Fakhar-Un-Nisa explains that growth will likely come first from commercial and residential projects. “I expect we will see continued new starts in high-rises, with supporting transit and urban infrastructure for those projects going hand-in-hand with any vertical undertakings.” Syeda has been with Hill since the company began work in Pakistan and helped to manage the Eighteen Islamabad (Elite Reverie) project, a multi-million-dollar mixed-use development in Islamabad.

Syeda cites the flurry of activity across Pakistan as further evidence the vertical sector is heating up. “In Lahore,” she explains. “The Development Authority has approved 121 vertical buildings for construction to meet the needs of the local population.” Also in Lahore, Syeda adds that the Lahore Central Business District Development Authority’s “Lahore Prime” project would realize a new mega-high-rise development in a central location close to transportation, services, and other amenities.

Another example Syeda cites is the massive Chand Tara Island development in Gwadar, where the Federal government plans to invest $10 billion in a joint venture with the China Communications Construction Company. “The master plan for Chand Tara would deliver the country’s first tax-free commercial zone for this trade hub area,” Syeda explains. “And would include a $5 billion investment in electricity generation and transmission infrastructure and $1 billion water desalination plants.”

“The Punjab government understands that vertical options offer the best solutions to accommodate more properties on a smaller piece of land, and the government is easing the process to achieve these projects,” she says.

Longer-term, Syeda expects mega-horizontal projects to drive the country’s growth, once residential and commercial construction has caught up with demand. Mega-projects on table in Pakistan include the $7 billion, 1,700 KM Main Line 1 rail alignment, which would connect Peshawar and go through Rawalpindi, Gujranwala, Lahore, Sahiwal, Khanewal, Bahawalpur, Rahimyar Khan, Rohri, Nawabshah, Hyderabad, and end at Karachi, upgrading facilities and related infrastructure along the entire route. “Heavy and light rail construction mega-projects will define much of the work ahead in Pakistan,” says Syeda. “In addition to Main Line 1, the Orange Line Metro and the Karachi Circular Railway are also in their early planning stages.”

Managing Risks, Realizing Opportunities: The Eighteen Islamabad (Elite Reverie) Project

“Having a bench of project and construction management professionals available in-country, supported by controls, estimating, and other experts from around the world can help investors keep control of their projects,” says Syeda.

Syeda notes that the Hill team’s work on the Eighteen Islamabad (Elite Reverie) project provides a case study of the value a talented management team can bring.

Hill was appointed as a project supervision consultant for the Eighteen Islamabad (Elite Reverie) development in Islamabad. The project entailed a 2 million SM-plus, mixed-use development that includes residential complexes with more than 2,000 villas and apartments, a retail and business park, a 20,000 SM five-star hotel, a mall, medical and sports facilities, education villages, recreational facilities, and 7,200 square yards of open space with an 18-hole golf course.

In the teeth of the COVID-19 pandemic, Hill oversaw the work of nine contractors with separate contracts on the project at any given time. Thankfully, Hill had local professionals available, the team was able to maintain contact with the client despite travel restrictions. Once adjusted for pandemic-related delays, the project enjoyed a successful conclusion.

“There is no substitute for a strong in-country presence,” says Syeda. “Just as there is no substitute for global experience to back that local team.”

Communication is Key

“The consultant-contractor relationship in Pakistan is one of tug of war and there is ample room for minimizing distrust and improving communications,” says Syeda.

“Planning is a significant part of any project and contractors often give an estimated completion date that they then find a Herculean task to maintain. They don’t put all relevant information on the table, and this leads to labor issues and delays in the delivery of materials, resulting in the overall project going over budget and experiencing delays.” She concludes, “A strong partner up front in the process can help make sure the entire team is on the same page and working towards the same goal.”

Hill Senior Vice President, Asia-Pacific, Said Mneimne offers his take on the Pakistan market. “Pakistan represents an opportunity for significant growth,” Mneimne says. “The government’s attention to the construction sector, combined with the demographic realities of the population, means that urban development simply must occur. Our plan at Hill is to help realize this growth, both in terms of horizontal and infrastructure projects, as efficiently as possible for our clients.”

Share

July 15, 2024 | Articles

Construction’s Digital Transformation & The Tools of Modern Project Management

July 10, 2024 | Articles

GC/CM at Post Falls: Managing Avista’s North Channel Dam Rehabilitation Project

June 23, 2024 | Articles

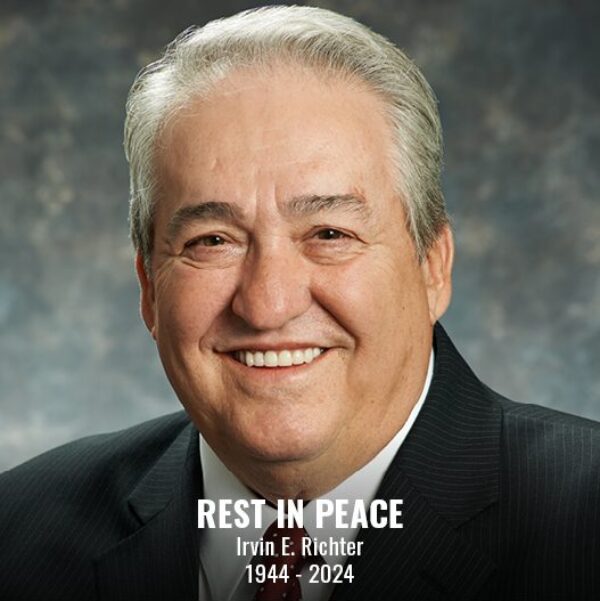

Irv Richter – An Innovator, A Pioneer, A Leader (1944 – 2024)

June 14, 2024 | Articles

Environment of Care Standards – Meeting the Challenge (Part Two)

June 13, 2024 | Articles

PMO for Public Transit Project Success: The Reopening of Philadelphia’s Franklin Square Station

June 7, 2024 | Articles

May 17, 2024 | Articles

Hill Interim Federal Market Sector Leader Jane Penny Receives Golden Eagle Award

April 11, 2024 | Articles

A Model Move: Managing Move-In at the Sylvia H. Rambo U.S. Courthouse