July 15, 2024 | Articles

Construction’s Digital Transformation & The Tools of Modern Project Management

In November, European battery industry leaders gathered at the Future Battery Forum 2023 in Berlin, Germany, to discuss the trajectory of the continent’s battery market. The assessments and insights of these specialists painted an optimistic picture of the industry’s future. Notable trends impacting the market include Europe’s ongoing energy transformation, the need for shortened supply chains, growing demand for new technologies, EU financial programs, and member state national plans. Despite the exciting prospects, industry leaders also noted the need to address challenges, such as material shortages and strong global competition, as well as uncertainties related to the global race to develop and introduce breakthrough technologies.

Among the leaders in attendance was Hill International, Inc. Operations Director, Western Europe Industrial Sector Leader Tomasz Karczewski, who has compiled the most important trends highlighted at the Forum, key takeaways, and his own recommendations on the future of the battery industry.

Growth Forecasts

Changes at the global level are propelling the EU’s battery market. Specifically, COVID-19, with its major impact on global supply chains, and competition between the U.S. and China have exposed the risk associated with Europe’s dependance on global market trends. As a result, European governments and private industry leaders are prioritizing independence and self-sufficiency in all markets. Europe also endeavors to be the world leader in decarbonization. Accordingly, reducing and ultimately abandoning fossil fuels in the energy production sector, increasing energy storage, and eliminating diesel/gasoline-powered vehicles is a necessity.

These factors underscore the vital role that batteries will play in shaping the future of Europe’s energy landscape and self-sufficiency. They have also created an impetus for EU and national funding for battery projects. Billions of euros from multiple EU investment streams, such as the Important Projects of Common European Interest (IPCEI) co-financing program, and national investment strategies, like Germany’s plans to build more than 200 GWh in battery production plants capacity over the next five years, will stimulate private investments in the battery industry and compound its organic growth. According to Global Market Insights, we can expect sustained growth until at least 2030.

Technological Disruptors

In the battery industry, production efficiency and supply chain dependencies are major factors in profitability and industry stability. Accordingly, the EU and European national governments are targeting these areas for investment. Speakers at the Forum indicated that innovation and new technologies will be the major strengths of Europe’s battery production market and drew attention to the need for technological diversification through alternative technologies such as solid-state batteries.

Solid-state batteries can be safer, last longer, and hold more energy than traditional lithium-ion batteries but are not yet commercially viable due to production costs. Forecasters expect mass production of solid-state batteries to begin in 2025-2026. However, current EU investments are driving research and development projects to accelerate implementation. Speakers at the Forum emphasized that solid-state batteries must be the research priority for Europe’s battery industry.

While researchers endeavor to scale solid-state batteries for commercial use, other developers are working on pioneering solutions like dry electrode technology, which, according to some experts, can reduce the operating costs of the battery industry by almost half. Regardless of the technological specifics, it is clear that scientists, visionaries, and their exciting technologies will be at the forefront of Europe’s battery industry, helping increase efficiency, deliver greater returns for investors, enable more projects and growth, and contribute to Europe’s broader sustainability and self-sufficiency goals.

Addressing Material Scarcity Locally

Until new technologies emerge onto the market, the most pressing challenge facing Europe’s battery industry is limited access to raw materials, especially lithium.

In July 2023, the EU codified its commitment to recycling batteries with the New Batteries Regulation, in line with the European Green Deal. This will contribute to reduced pollution and greater autonomy for European industry. However, European battery independence will also require close collaboration with the private sector. With new targets for recycling to be introduced starting in 2025, private manufacturers must prepare to pivot towards a circular battery economy now.

To adapt, private manufacturers will need to lean into local solutions and align business practices with local needs. For example, though the global battery industry still prefers gigafactories with capacities in excess of 30 GWh, smaller factories with capacities up to 2 GWh can be more sustainable and respond more flexibly to local requirements. Several initiatives in Southern Europe, such as the Basquevolt project in Spain, embody this emerging trend, and, at the Forum, multiple presenters argued for a downwards shift in scale based on enhanced efficiency and agility.

Collaborative Global Strategies

While local solutions will advance Europe’s battery industry, challenges related to raw materials and global competition will remain pivotal issues in the coming years. Asia will continue to dominate the lithium-ion battery sector, with annual growth expected to reach nearly 30% through 2030. European industry leaders will need to take up a strategic, partnership-oriented approach to competing and collaborating with their peers in the global market.

Ambitious projects led by global companies, undertaken with funding from global developers or executed globally, can help drive Europe’s growth. For example, Germany aims to leverage Asian investments in addition to EU investments to charge its national plans to build more than 200 GWh in battery capacity over the next five years. Hungary has established itself as a hub for global battery production, attracting billions of euros in investments and collaborating with German automakers and Chinese and South Korean battery suppliers. Meanwhile, Sweden’s Northvolt and Germany’s Volkswagen are investing billions in North American battery manufacturing plants. Such creative global partnerships will spur additional investment in Europe’s battery industry and support sustainability globally.

Recommendations and Takeaways

In addition to their many applications in home appliances, smartphones and computers, batteries can help create a greener and more sustainable future by changing the way we manage energy production, distribution, storage, and consumption. As efforts to combat climate change continue to escalate, governments, private investors, manufacturers, researchers, and industry leaders are eyeing opportunities to increase battery capacity, take advantage of the industry’s growth, and make batteries and battery production processes more efficient.

Europe, thanks to its mature markets and scientific infrastructure, can be one of the main players in the global battery industry. For that to materialize, the EU should continue funding projects and research into technological solutions and prioritizing recycling projects to create fertile ground for the industry’s continued growth. On a national level, European governments should study the optimal scale for battery production in their countries and work to leverage their country’s available resources, including both raw materials and professionals in science, technology, engineering, and mathematics (STEM) fields. Private companies should continue exploring creative global partnership opportunities. In this way, Europe’s battery industry will be able to prolong its growth and take maximum advantage of its position in the global battery supply chain.

About the Author: Tomasz Karczewski serves as Operations Director, Western Europe Industrial Sector Leader at Hill International, Inc. He has more than two decades of professional management and engineering experience. His support leads project teams in the industrial sector to consistent success. For further discussion or any questions, please reach out to Tomasz directly at [email protected].

Share

July 15, 2024 | Articles

Construction’s Digital Transformation & The Tools of Modern Project Management

July 10, 2024 | Articles

GC/CM at Post Falls: Managing Avista’s North Channel Dam Rehabilitation Project

June 23, 2024 | Articles

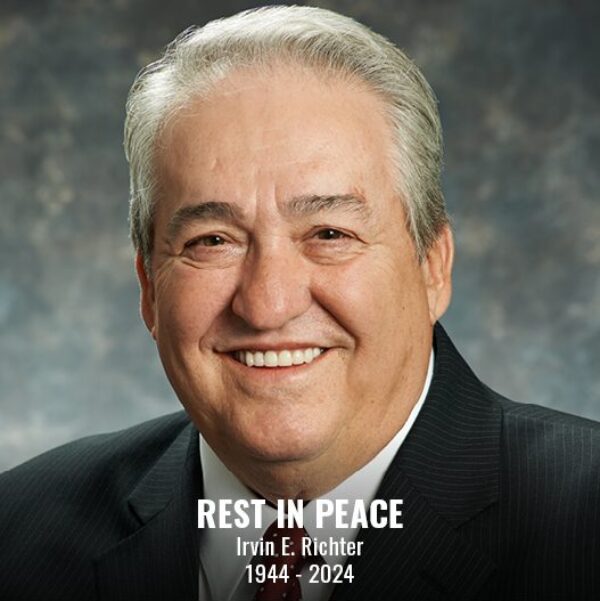

Irv Richter – An Innovator, A Pioneer, A Leader (1944 – 2024)

June 14, 2024 | Articles

Environment of Care Standards – Meeting the Challenge (Part Two)

June 13, 2024 | Articles

PMO for Public Transit Project Success: The Reopening of Philadelphia’s Franklin Square Station

June 7, 2024 | Articles

May 17, 2024 | Articles

Hill Interim Federal Market Sector Leader Jane Penny Receives Golden Eagle Award

April 11, 2024 | Articles

A Model Move: Managing Move-In at the Sylvia H. Rambo U.S. Courthouse