With supply chain snags, labor shortages, and inflation worries making for a perfect storm of challenges, data center owners and builders are searching for solutions to realize their projects as planned. One potential solution is to integrate the tools and techniques of vertically integrated supply chains into the data center construction project lifecycle.

Demand for data center materials, from steel to transformers, is far outstripping supply. A 2022 Q1 report from TurtonBond, for example, sees double-digit price increases in such data center must-haves as steel, HVAC systems, and switchgear and controls. In addition, contractors can afford to be selective as there is plenty of work for good firms to choose from. Perhaps, according to at least one source, enough work to threaten the ongoing boom in data center construction. This scenario is resulting in projects held up by months, or even years, as they wait for long lead items to arrive on site. The result is missed milestones, underwhelming ROI, and languishing projects.

Linking Up: How Vertically Integrated Supply Chains Work

Increasingly, owners, including global name brand organizations, are looking for new ways to address these material and labor shortages. One possible option is to adopt the principles of vertically integrated supply chains. Vertical integration involves the acquisition of key components (in the case of data centers, components on the Critical Path) that the owner/builder previously would procure from a vendor. When successful, a vertically integrated supply chain can deliver:

Non-construction examples of vertically integrated supply chains include Netflix, which famously and successfully moved from being a DVD rental operation into a content creator and proprietary streaming platform, and, more traditionally, Target, which designs, manufactures, distributes, and sells products under its own brand in its own stores. While a streaming service built on binge-watching and a big box store filled with consumer goods might not seem like obvious parallels to data center construction, in fact there are lessons to learn from both companies.

First, Netflix optimizes its vertical integration by entering into true partnerships with its content providers. Adopting a similarly cooperative approach to partnering with vendors and suppliers could help owners to manage expectations downstream and increase cost and schedule certainty—as opposed to learning days before an anticipated delivery of a months-long delay. Another example is how Target specifies its products to match the market, rather than waiting for the market to dictate its preferences. Data centers often enjoy a high degree of customization, but, at the end of the day, a transformer is a transformer just as a spatula is spatula: make it reliable and sell it a fair price, and people will buy it.

Building at Scale: The Power of Standardization Across Supply Chains

More specifically to construction projects and programs, vertically integrated supply chains can enable owners to build at scale.

A company I work for that specializes in data center project and construction management, Hill International, recently completed a spreadsheet with 8,000 individual line items need for data center construction for a global information technology company. From paper towel racks to cable trays, this spreadsheet can provide a template for the owner to get ahead of potential delays and see the bigger picture of their projects. Combined with a partnership mindset to procurement, this tool alone could deliver the organization increased cost control across its entire portfolio.

This scenario is achieved by balancing space, size, and speed requirements, which then enables the owner to sync their project requirements with industry demand. Likewise, a portfolio review of the owner’s programs and projects can align organizational goals with the realities on the ground: is it better to buy, build, lease, etc.?

Also specific to construction is how vertically integrated supply chains support the potential of turn-key project delivery, built to set organizational standards. While turn-key delivery would eliminate much of the customization that goes into some projects, it would also bypass many supply chain hiccups and place more risk on the builder, who would, in theory, understand better the constraints of the market and how to address these challenges.

Finally, large IT organizations could use vertically integrated supply chains to, in part, dictate means and methods and, to a point, materials for their projects. For example, a global provider could create incentives for the local market to meet their specific needs, while also finding ways to align those construction needs with available expertise and materials. Again, this approach would require a high degree of standardization, but the potential payoffs could well offset any schedule risks.

Vertically Integrated Opportunities

These are only a few of the ways data center and mission-critical builders and owners could deploy the philosophy of vertically integrated supply chains into their own programs and projects. Others might include increased component stocking, more component prefabrication, and a truly co-op approach to procurement, with several builders making larger purchases to gain delivery confidence.

Savvy builders will, undoubtedly, find their own nuances and opportunities to make integration work for their projects. However, to continue to meet market demand for new projects profitably and reliably, vertically integrated supply chains present an intriguing opportunity for owners to consider.

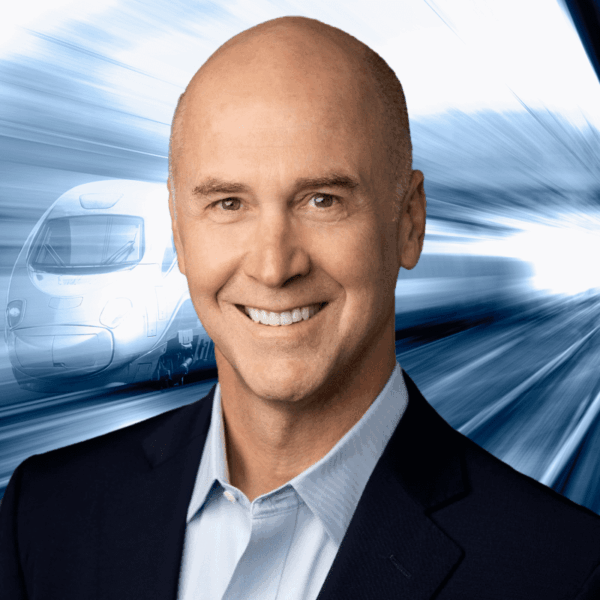

Hill International Director, Data Centers Rob Nash-Boulden has more than over 30 years of experience in the data center and mission critical industry with clients such as Amazon, American Express, Digital Realty, Cologix, Cyrus One, eBay, Intel, Internap, LabCorp, Microsoft, SalesForce, Uber, and CREE.

Share

June 23, 2025 | Articles

Jeffrey Hurley Joins Hill’s Northern California Rail Practice

June 23, 2025 | Articles

Ready, Set, Grow: First VP Chad Koelling Takes Charge of Hill’s Mountain West Region

June 8, 2025 | Articles

PMO in Saudi Arabia: The Holistic Approach to Realizing a National Mega-Portfolio

June 1, 2025 | Articles

May 26, 2025 | Articles

May 12, 2025 | Articles

Keeping Your Water/Wastewater Programs Flowing with Public Relations

April 27, 2025 | Articles

Oiling the Machine: Steps to Successful Permitting on Infrastructure Megaprojects

April 20, 2025 | Articles

Sustainable Scaling: Solutions for Managing Risk on Europe’s Data Center Projects